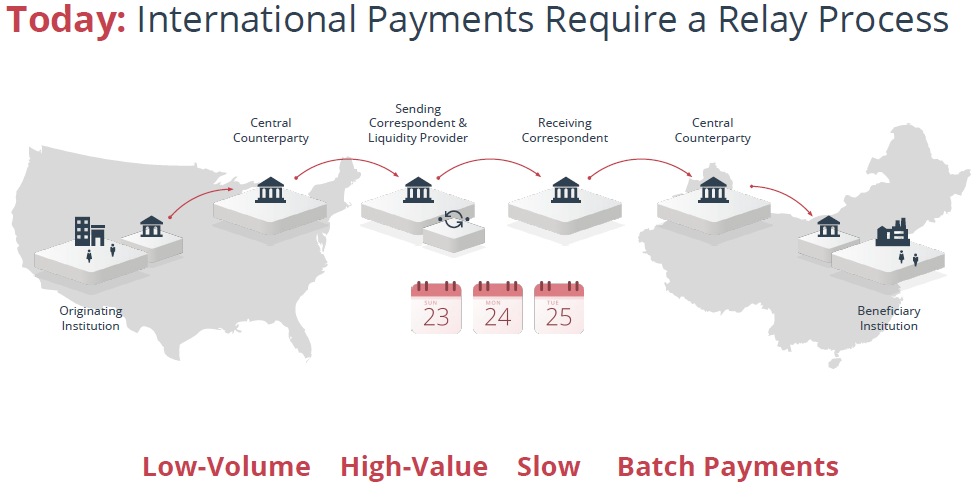

Imagine that Kevin, a customer at a Wells Fargo branch in New York, needs to send money to his family living in Thailand. In order to send money from his account to their Siam Commercial Bank account, he would need to walk into Wells Fargo with his family’s account number and provide the unique SWIFT code for their Siam Commercial Bank branch. Wells Fargo would then initiate a payment transfer to Siam Commercial Bank which would take 3-5 days to clear, at which time the funds would be credited to the family’s account.

For the past 40 years, the Society for Worldwide Interbank Financial Telecommunications (SWIFT) has dominated the market for these types of cross-border transactions by developing an expansive messaging network between banks to securely send and receive money transfer instructions. The whole process, however, like many others in today’s ever-evolving world of technology, is in need of a new and improved solution that might be just around the corner.

Hate It or Love It

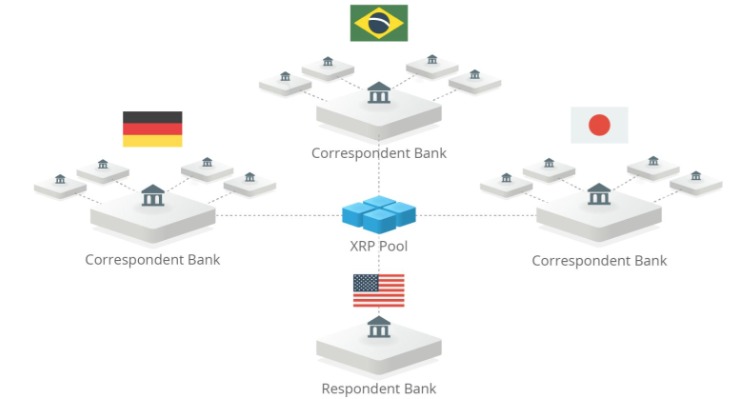

The Ripple Consensus Ledger is an open source, account-based chain, which requires no mining to be performed to validate transactions. Ripple Labs, a venture-backed startup, created the third-generation chain with the goal of enabling frictionless global fund transfers. The native currency XRP acts as a liquidity measure, or standard measure of value, which the banks can exchange to increase transfer speed and decrease costs. Just how fast is the Ripple protocol? When compared to digital alternatives Bitcoin (7 transactions per second) and Ethereum (15 transactions per second), it becomes obvious that Ripple (1500 transactions per second) is the clear victor, processing transactions in mere seconds. An interesting caveat to take note of is that banks do have the option to use only the transfer software without engaging the digital currency XRP. If an institution elects to do so, money transfer costs decrease by only 30%, whereas full engagement is incentivized by a 60% cost decrease.

Tsunami on the Horizon?

Ripple is holding a massive conference in October which will no doubt increase hype around the coin. Technical analysis shows strong consolidation along its support line, signaling a possible reversal into a new bullish trend.