Alibaba is a Chinese based company that specializes in connecting business and consumers in order to provide cheap manufacturing services to almost anyone in the world. The company was founded by Jack Ma in 1999 and was taken public in 2014. At the time, it was the biggest IPO in US history, with shares starting at around 92 dollars.

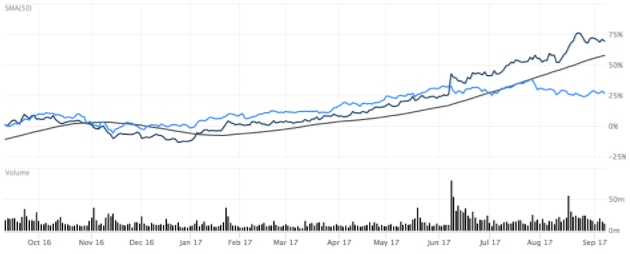

These days Alibaba is trading at right around 170 dollars per share, boasting a revenue of 23.74 Billion dollars per year, and growing at a staggering 48 percent in 2017 alone. Oh, and did I forget to mention that BABA generates more revenue than Amazon and Ebay COMBINED? Take a look at the chart below, with Amazon in the light blue and Alibaba in the black. BABA has consistently kept pace with Amazon and began to break free in June of this year.

Bottom line, if you like Amazon, you should be taking a close look at Alibaba. Look up the word, “growth”, in the dictionary, and you might just find Alibaba’s logo right there next to Jack Ma’s face. I would not be surprised to see the share price break $200 by the end of 2017. The company is simply such a powerhouse in the e-commerce sector. This stock could be considered a cornerstone of anyone’s portfolio.

Disclaimer: This is not investment advice, it is merely an opinion for informational purposes. Investing is a risky matter, people should do their own research and we are not liable for potential losses.